The long put option is the 'option' to buy a leveraged i.e. via collateralized credit, position in a certain number of a businesses shares at a specific price. A fee is charged for the use of an options contract that creates a price spread within which the option user will not yield a profit. Investors use options when they want to increase their potential earnings though purchase and/or sale of stocks. This article will discuss what options and put options are, how they are priced and why investors consider them.

Options explained

Options contracts such as stock options are made with a securities dealer to buy or sell underlying financial products such as commodities, currency, shares, carbon emissions points etc Moreover, as noted above, options investing is a form of leveraged investment in which the investor is able to increase one's investment position for potential greater gain or loss. For example, an investor may purchase 1 option to buy XYZ company before November 30, of a given year. The option itself will be priced by the market and represents a multiple of shares such as 1 option=100 shares.

Options exist in two types calls and puts and can be both bought and sold. Call options have the potential to yield gain if the underlying share price rises whereas put options are the opposite i.e. a drop in underlying share price. The long put option is a type of option where the investor banks on the decline of a price value and retains the 'option' to buy a certain amount of shares at a pre-determined price.

As the name 'option' implies, the option entails the choice to either buy or sell an underlying security and not the requirement. Such being the case, investors may be able to limit potential losses to the premium cost i.e. fee of the option. This is called options "covering" as in covering as short position to protect against a rise in underlying security price.

How options are priced

The cost of options contracts are different from the options price and are three essential variables 1) the fee, 2) the option price and 3) the option loss if any. The fee charged by the securities dealer to facilitate the contract may vary from broker to broker and the option price itself is determined by several variables making it more complicated to determine a fair price.

Option price variables:

The variables that go into the pricing of an option can help an options investor determine if the option is fairly value i.e. not inflated in price and cost. Knowing the fair price of an options contract can assist the investor in minimizing the cost part of the profit venture. Specifically, the variables that go into the cost of an option include the following:

• Underlying securities price

• Market conditions

• Term of the contract

• Exercise/strike price

• Market conditions

• Term of the contract

• Exercise/strike price

The above variables determine the risk of the option which in turn translates into price. The higher the risk, the lower the cost tends to be whereas the lower the risk, the higher the price of the option often is. For example, if a strike price i.e. choice to buy or sell, is within 5% of the current underlying security price, the risk of that security not reaching that price is lower than a 10% change, therefore increase the risk cost.

Pricing methods:

There are several ways to price an option in determining whether it is fairly priced or not. Three such methods include 1) mathematical equation 2) investment software and 3) Options guides and 4) investing intuition. Of these methods the last, investment intuition is the most speculative and holds the greatest risk of inaccurate pricing assessment. The first method, i.e. mathematical equation involves entering various variables into a theoretical pricing model to come with a fair price calculation. Investment software and guides may also have build in models or pre-calculated data to assist the investor in this task.

Why use a long put option?

A long put option may be a way to make larger profits in a shorter period of time without risking more than the options premium i.e. the fee for the option contract. Simply put, it can help one make more money faster. However, this is not done without risk and involves making an investment decision based on a number of market and business variables including the unknown future.

Long put option

At best, investors make a strongly calculated and intuitive decision that lowers the probability of failure i.e. loss thereby increasing the probability of maximizing profit. At worst, a poor option decision can lead to a higher probability of failure and a multiplied loss of money since options contracts are leveraged investments. For the latter of the above two reasons, options trading should be considered carefully in terms of available investment funds, loss provisions, investment accuracy, and investment know how.

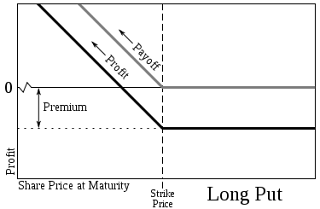

The long put option is used when an investor, broker or speculator thinks the price of an underlying security will fall. By locking into pre-determined option price, the investor can then buy the put option if the price falls and thereafter sell a greater amount of shares than actually purchased at a higher price than the fallen security value. The difference between the strike price and the actual price of the underlying commodity minus the cost of the contract will then determine any profit.

Sources:

1. http://www.investopedia.com/terms/p/putoption.asp

2. http://www.optiontradingtips.com/strategies/long-put-option.html

3. http://www.smartmoney.com/options/index.cfm?Story=pricing1111

4. http://www.valueline.com/edu_options/rep1.html

5. http://www.investorwords.com/4559/short_squeeze.html

:.

:.

0 comments:

Post a Comment