Friday, September 30, 2011

The money fight on debt mountain continues on

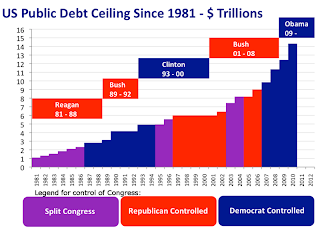

Republicans and Democrats continue to experience disagreements over something they previously did not have such extensive limitations on, money. Now the national debt has exceeded $14.7 trillion per the U.S. Treasury Department, and deficit spending continues on according to the Congressional Budget Office it has reached a point where caution is not only wise but necessary.

Politicians have to find ways to solve national issues while simultaneously meeting the demands of their constituents. That has lead to political infighting and gridlock that has caused the public to become disturbed by the effectiveness of Washington's problem solving abilities. According to Senator Jeanne Shaheen of New Hampshire "Congress has repeatedly failed to pass 12 annual spending bills on time..." Even before this year, the Atlantic reported 80 percent of the public do not trust the government in reference to a Pew Research Center study.

Politicians have to find ways to solve national issues while simultaneously meeting the demands of their constituents. That has lead to political infighting and gridlock that has caused the public to become disturbed by the effectiveness of Washington's problem solving abilities. According to Senator Jeanne Shaheen of New Hampshire "Congress has repeatedly failed to pass 12 annual spending bills on time..." Even before this year, the Atlantic reported 80 percent of the public do not trust the government in reference to a Pew Research Center study.

Image source: Frits Ahlefeldt

Even though administrative goals are attempting to cut deficit spending via a 'Congressional Super Committee', the actual affect on national debt will still be negative. This is because cuts in deficit spending only reduce the amount of debt accumulated each year, and not the national debt which includes budget debt added on from previous years. This means national debt will continue to expand and Social Security and Medicare 'entitlements' will be pressured to find a sustainable source of financing.

Without an improvement in the economy government tax receipts rise. How that is supposed to occur is one of the things GOP members and Democrats argue about, the latter seeking to raise taxes on the wealthy and the former hoping to boost revenue through deregulation and pro-business legislation. With a Republican majority in the House and a Democratic majority in the Senate ideological differences will either be compromised or lead to legislative delays. For example, Fox News reported only around 70 legislative bills will been signed by the President this year whereas 230 were last year.

Copyright CC-BY-SA-3.0 Attribution "Unforgettable Fan"

Without an improvement in the economy government tax receipts rise. How that is supposed to occur is one of the things GOP members and Democrats argue about, the latter seeking to raise taxes on the wealthy and the former hoping to boost revenue through deregulation and pro-business legislation. With a Republican majority in the House and a Democratic majority in the Senate ideological differences will either be compromised or lead to legislative delays. For example, Fox News reported only around 70 legislative bills will been signed by the President this year whereas 230 were last year.

Financial News and Commentary for the Business Week Ending 09/30/2011

This week mostly saw confirmation of the previous weeks trends in terms of economic data released. The majority of statistics released confirmed stagnant to recessionary pressure on the U.S. economy. European debt management issues and a Chinese manufacturing slowdown also weighed on markets. A couple of good reports indicated some positive business growth, specifically the Chicago Business Barometer and the Kansas City Federal Reserve Banks' Composite Manufacturing Survey.

Even though the University of Michigan Consumer Sentiment rose 3.7 percent according to MarketWatch, the Conference Board Consumer Confidence Survey only rose .2 percent, a significant variation. Additionally, manufacturing decreased in multiple regions despite improving in some parts of the Midwest. Manufacturing represents a shrinking to stagnant aspect of the U.S. labor force per William Strauss of the Chicago Federal Reserve Bank. Unemployment numbers were cited as being a-typical, unseasonal and statistically inaccurate by MarketWatch and Zero Hedge.

Even though the University of Michigan Consumer Sentiment rose 3.7 percent according to MarketWatch, the Conference Board Consumer Confidence Survey only rose .2 percent, a significant variation. Additionally, manufacturing decreased in multiple regions despite improving in some parts of the Midwest. Manufacturing represents a shrinking to stagnant aspect of the U.S. labor force per William Strauss of the Chicago Federal Reserve Bank. Unemployment numbers were cited as being a-typical, unseasonal and statistically inaccurate by MarketWatch and Zero Hedge.

• Commerce Department: August disposable income declines .3%

• Value of Euro per Dollar reduced by .10 cents in September

• SBT: Economic integration sought to stem lower exports to West

• Chinese manufacturing indicates 2 month contraction per Barron's

• German unemployment declines to 6.9% according to Reuters

Source: Bureau of Economic Analysis

Thursday, September 29, 2011

Financial News 09/29/2011

• ECB: Average August Eurozone inflation 2.5%

• NAR: August U.S. pending home sales index declined 1.2%

• Japanese August retail sales drop 2.6% per Asiaone News

• 2Q GDP revised up by BEA on expenditures, and exports

• French banks tightening liquidity per Fitch via WSJ

• Bloomberg: 8 Italian banks' credit downgraded or revised

• NAR: August U.S. pending home sales index declined 1.2%

• Japanese August retail sales drop 2.6% per Asiaone News

• 2Q GDP revised up by BEA on expenditures, and exports

• French banks tightening liquidity per Fitch via WSJ

• Bloomberg: 8 Italian banks' credit downgraded or revised

The hands behind currency valuation

Currency valuations affect a lot of things and are themselves influenced by still more variables. The strength of a nations' labor force in terms of skill, marketability, productivity and economic growth builds confidence in a currency. The Yuan Renminbi or RMB is an example of an emerging global currency that is increasingly being used as a reserve currency by other nations according to CNN International.

Image source: Fran Hogan

• Federal Reserve: $9.545 trillion in checking, saving and M.M.F.sGovernment fiscal policy, like central bank monetary policy also plays a role in the valuation of currency. Sometimes this is done to the detriment of an economy per Hedge Fund Manager David Einhorn in a New York Times Op-Ed. More specifically, Einhorn states our government's use of cash basis accounting understates the actual financial obligations taken on by an increasingly unsustainable cash-flow. Moreover, it is the money made from the hands of a nation's people that fiscal decision makers are themselves handling.

• Issues in Political Economy: Equity rises increase currency strength

• Commodity prices rise with dollar depreciation per the FAO

• Countries de-value currency to boost exports per The Economist

• 33-50 percent of post Civil War currency was counterfeit per FBSF

• The $ symbol is believed to originate from the Spanish Dollar

Monetary policy also plays an important role in currency valuation. Since central banks can change money supply, they can also change the value of money by increasing or decreasing the amount of money in an economy. Altering money supply enhances economic performance at best and is an economy eroding cancer at worst. When the value of money erodes or loses purchasing power, inflation protection helps preserve net worth and becomes useful in long-term financial planning. The valuation of different currencies represent various nations' economies and competition between those economies.

Wednesday, September 28, 2011

Financial News and Commentary 09/28/2011

The recent rise in U.S. and European equity prices seems to be more of a relief rally if fundamental financial and economic data has any bearing on market movements. That is also notwithstanding the influence of high frequency trading which according to a study cited in Bloomberg, "exacerbates moves". According to the Journal of Investment Strategy Midas Opportunity Fund Letter, the global jobless rate is on course to negatively restrict the number of jobs available to a growing population.

Image source: Frits Ahlefeldt

• Census Bureau: August demand for durable goods declined .1%

• Greek bank's leveraged structured finance downgraded by Moody's

• SBT: M&A activity declines 22% in 3Q 2011

In addition to sour employment news, net capital inflow into private equities declined for the four months of April through July 2011; rather and a shift of capital into longer-term Treasuries in June and July occurred. Net capital outflow was $7.4 billion with a larger flight from private equity of $ 44.4 billion not offset by other private investments.

By selling $400 billion short-term government securities and purchasing $400 billion in longer-term securities however, the Federal Reserve Bank intends to lower long-term interest rates. This could stem capital inflow into longer-term securities and encourage a shift into more promising securities such as equity investments. However, that sentiment also depends on what is considered a safe haven for capital, and possibly irrespective of yield.

Unappropriated Versus Restricted Retained Earnings

The primary difference between unappropriated and restricted retained earnings is the former are available for common shareholders where the latter is allocated for specified purposes. Both represent corporate equity that is originally income transferred to the balance sheet.

Complete article link: http://smallbusiness.chron.com/difference-unappropriated-retained-earnings-restricted-retained-earnings-25437.html

Tuesday, September 27, 2011

Economic Indicators: U.S. Wealth Shifting and Losing Value

Americans' wealth is neither keeping up with inflation nor global growth. The shifting wealth trend is discussed in depth and using GDP per person data in the Economist magazine. Comparing inflation statistics with personal income growth data below demonstrates declining wealth in the U.S.. To make things worse, The Jarkarta Globe quotes a Merrill Lynch Economist as saying "we will have to deal with a sharp slowdown" in reference to Asian economies.

• BLS reports 4.8 percent '09-'10 drop in consumer expenditures

• 1Q and 2Q revised annualized GDP .7 percent per the BEA

• BEA: State personal income growth 1.1 percent in 2Q 2011

• 12 month consumer price increases 3.8 percent per the BLS

Moneycation also reported yesterday data released by the Federal Reserve Bank of Chicago showed national economic activity has turned negative. About a week ago the Federal Reserve Bank Board of Governors stated a significant economic slowdown was being observed. Zero Hedge also shed on light an untypically candid or uncensured opinion of a trader interviewed on BBC. The video is worth watching even if only for its uniqueness

Financial News 09/27/2011

• NYT: Russian Finance minister asked to resign for doubting policy

• U.S. home prices rose .07 percent in July per Case Schiller Index

• Italian and Spanish bond yields/costs rise according to Bloomberg

• Conference Board: Consumer confidence little changed at 45.4

• China highly restricts foreign direct investment per OECD

• U.S. home prices rose .07 percent in July per Case Schiller Index

• Italian and Spanish bond yields/costs rise according to Bloomberg

• Conference Board: Consumer confidence little changed at 45.4

• China highly restricts foreign direct investment per OECD

Monday, September 26, 2011

Financial News 09/26/2011

Image source: Kosta Kostov

• Bundestag Eurozone bailout/veto power vote Thursday per Xinhua

• CFNAI economic index shows contraction pressures

• Greeks strike again to protest austerity according to ABC

• The Economist: Global economic shift unlikely to be super smooth

• Texas manufacturing stats from Dallas Fed show mixed messages

• Gold price per troy ounce down over $200 since August

Friday, September 23, 2011

Financial News and Commentary for the Business Week Ending September 23, 2011

• Global DJIA reaches lowest level in over a year per MarketWatch

• Congressional funding bill delayed in Senate

• SBT: Multiple banks in Greece downgraded by Moody's

• Gold price falls $150 per Troy ounce in 5 days

• Sean Egan via CNBC: "1.8 Trillion Euro debt bailout needed."

Image source: Peter Kratochvil

A tumultuous week for economies linked to European assets this week. With a Greek national bankruptcy looming, financial solvency has become a real concern for European financial institutions. This fear led to a steep declines in global stock markets and commodities prices; market volatility as measured by volatility in the S&P 500 (VIX) also approached two year highs. Leaders and economy watchers remain confident and optimistic that eventually this will all be solved, however a statement by the Federal Reserve Bank earlier this week seems to indicate this solution won't be in the very near-term.

Thursday, September 22, 2011

Financial News 09/22/2011

• NYT: Government financing bill rejected in U.S. House of Representatives

• Japanese exports fall short per Singapore Business Times

• SMH: Chinese manufacturing declines for third month

• Dollar Index reaches new 6 month high

• Moody's downgrades Bank of America and Citigroup

• Federal Reserve Bank: "Significant downside risk to U.S. economy"

Wednesday, September 21, 2011

Financial News 09/21/2011

Image source: Peter Kratochvil

• Volatility in Euro markets to persist per Hargreaves Lansdown

• SBT: British deficit spending reached $25 billion in August

• August home sales rise 7.7% at low rates per MarketWatch

• MSCI Emerging Market Index (MXEF:IND) correlated to DJIA

• WSJ: U.S. Federal Reserve expected to unveil bond reshuffling

Tuesday, September 20, 2011

Financial News 09/20/2011

Even though bond yield curves for distressed or pressured sovereignties such as Italy, Greece and Spain have risen, the bond yield curves for the Euroarea as a whole have actually declined per the European Central Bank.This indicates European peripheries are a monetary drag on the Eurozone's economy and that the affect of fiscal contagion has not so far greatly affected confidence in European debt.

A comparison between the dollar index and the Euro currency also indicates the relative current strength of the Euro and the European economy overall. However, if confidence in the Eurozone's ability to deal with solvency problems does fall via a domino affect of asset prices i.e. contagion, a flight to the dollar would presumably lower the price of commodities in the short-run and consequently lower equity indexes i.e. stocks and funds invested in those commodities.

• Apple Inc. share price reaches all time high over $421.00 per share

• ECB: Euroarea comparative 12 month 30 yr bond yield curves merge

• Italian bond yields rise with S & P's downgrade per the WSJ

• IMF downgrades global economic growth to 4 percent

• Real estate data disappoints per MarketWatch

• DJIA experiences unsubstantiated morning rally

Monday, September 19, 2011

Financial News 09/19/2011

• Cyber attacks on U.S. financial system rising per FBI

• IMF: €200 billion potential default loss per the Economist

• State incomes spur negative credit ratings per Yahoo Finance

• FDIC approves rule protecting consumers from financial insitutions

• Gold price range bound near $1,800 per troy ounce

• Italy's Aa2 credit rating on review by Moody's

• WSJ: Obama proposal to cut $3.2 Trillion unlikely to pass

• IMF: €200 billion potential default loss per the Economist

• State incomes spur negative credit ratings per Yahoo Finance

• FDIC approves rule protecting consumers from financial insitutions

• Gold price range bound near $1,800 per troy ounce

• Italy's Aa2 credit rating on review by Moody's

• WSJ: Obama proposal to cut $3.2 Trillion unlikely to pass

Sunday, September 18, 2011

How businesses write up work-orders

Knowing how to write up a work order can improve a business' work-flow process, if not help save a business operation from inefficiency. Work orders and work order systems vary between businesses but can be written up to meet business job or project needs effectively. For example, if a business has a lot of client field jobs, a mobile work order system with GPS, and integrated data transfer can speed up and improve worker efficiency.

Work orders are the medium with which business tasks are documented, implemented with and recorded. Some types of work orders might involve completing a form, recording it on a computer system then delivering it to the project manager or appropriate worker, while others might consist of a verbal order and a computer entry. The following steps can help with properly knowing how to create and implement a work order.

• Define

Defining what a work order is to do is key in writing or creating a work order. If the work order doesn't have the right information on it, or isn't compatible with the business operation it is used for, then it may be incomplete, or incomprehensible. To illustrate, if clients are often on the internet, a web based order mechanism can be automatically transferred and entered into the work order system by the client.

• Develop

Either create a work order template or locate a work order software. If work orders need to be duplicated, an affordable duplication method may be used. For example, electronic orders or audio dispatch. Work order software that can be integrated with existing business applications may be idea. For example, DeFNiC has a work order software that integrates with Quicken.

• Optimize

A well designed work order will only have necessary information and not redundant data. Work orders should be quickly created, recorded, organized, adjusted and released in a cost effective way. If combining a work order with a job order, information such as job instructions and materials used can be added with the order number, date, account, job description, client, and costs.

• Review

After the work order process is complete put it to the test by reviewing how well it works on a limited basis. The work order system can be tested on one or two clients using one or two responsible employees for feedback and observation. Weed out any bugs or flaws in the system sooner rather than later and before making the work order system primary or live.

• Refine

As work is completed the work order should be accurately updated. A cloud computing work order software such as Service Max, or Adhere Solutions work order management may be the right tool this. If the software is also electronically linked to an accounts receivable account and other financial records, this may help reduce bookkeeping time and errors.

A work order mechanism can be as simple or as complicated as you want it to be. Some work order processes may be complex and detailed, even if stated to be simplified; an example being government purchase work orders. Each business is likely to have specific template requirements and bookkeeping systems. For this reason, making a work order adaptable within an accommodating work order mechanism is especially effective in dynamic and ever changing business operations.

Work orders are the medium with which business tasks are documented, implemented with and recorded. Some types of work orders might involve completing a form, recording it on a computer system then delivering it to the project manager or appropriate worker, while others might consist of a verbal order and a computer entry. The following steps can help with properly knowing how to create and implement a work order.

• Define

Defining what a work order is to do is key in writing or creating a work order. If the work order doesn't have the right information on it, or isn't compatible with the business operation it is used for, then it may be incomplete, or incomprehensible. To illustrate, if clients are often on the internet, a web based order mechanism can be automatically transferred and entered into the work order system by the client.

• Develop

Either create a work order template or locate a work order software. If work orders need to be duplicated, an affordable duplication method may be used. For example, electronic orders or audio dispatch. Work order software that can be integrated with existing business applications may be idea. For example, DeFNiC has a work order software that integrates with Quicken.

• Optimize

A well designed work order will only have necessary information and not redundant data. Work orders should be quickly created, recorded, organized, adjusted and released in a cost effective way. If combining a work order with a job order, information such as job instructions and materials used can be added with the order number, date, account, job description, client, and costs.

• Review

After the work order process is complete put it to the test by reviewing how well it works on a limited basis. The work order system can be tested on one or two clients using one or two responsible employees for feedback and observation. Weed out any bugs or flaws in the system sooner rather than later and before making the work order system primary or live.

• Refine

As work is completed the work order should be accurately updated. A cloud computing work order software such as Service Max, or Adhere Solutions work order management may be the right tool this. If the software is also electronically linked to an accounts receivable account and other financial records, this may help reduce bookkeeping time and errors.

A work order mechanism can be as simple or as complicated as you want it to be. Some work order processes may be complex and detailed, even if stated to be simplified; an example being government purchase work orders. Each business is likely to have specific template requirements and bookkeeping systems. For this reason, making a work order adaptable within an accommodating work order mechanism is especially effective in dynamic and ever changing business operations.

Sources:

1. http://bit.ly/cRcK32 (U.S. Government Printing Office)

2. http://bit.ly/9ivsjt (Miami Dade College-J.Hortens)

3. http://bit.ly/dvMPyU (DeFNic)

4. http://bit.ly/dlx3hl (Service Max)

5. http://bit.ly/cL1BD6 (Adhere Solutions)

Differences between data warehousing and business intelligence

The primary differences between data warehousing and business intelligence are in function and design. Data warehousing refers to the process, mechanism and infrastructure utilized in the preservation of digital information. Business intelligence on the other hand, is the use and analysis of information, some of which may be obtained via data warehousing. This information is used for the decision making pertaining to the operation of a business.

The State of North Dakota describes business intelligence thoroughly in its 'Business Intelligence Report'. Specifically, the white paper describes business intelligence in terms of technology and infrastructure such as data mining information held within a data warehouse and using the appropriate software to perform data analytics. This helps in designing business models that have basis in logical, mathematical and qualitative assessment of business data.

Data warehousing can be thought of as a component of business intelligence that has wider scope. However, without adequate data warehousing, effective business intelligence may have little to draw valid conclusions from and therefore lead to faulty decision making. Thus, data warehousing ideally possesses qualities such as strong organization, easy access, time sensitivity and relevance. Since data warehousing takes physical space used by hardware storage, practically making use of space, and equipment to store sufficient data also involves prudent determination.

The objectives of data warehousing and business intelligence further delineate differences between the two. For example, business intelligence attempts to define, assess, observe, forecast and calculate for the benefit of a business; this is usually or ultimately financial in nature by design and function of a business. The corresponding function of data warehousing is to serve the interest of business intelligence and other business data storage needs.

Further differences between data warehousing and business intelligence include variation in software applications, employee tasks, cost and hardware needs. For example, an information technology (IT) professional familiar with magnetic, optical and solid storage devices would more likely be involved with data warehousing than an executive marketing manager seeking to make use of marketing research to implement a new product launch.

The service industry itself is differentiated in such a way as to distinguish between data warehousing and business intelligence. This is because managerial science and information technology become specialized and require specific knowledge in data warehousing and business intelligence.

Differences arising out of, and between data warehousing and business intelligence may also have the potential to lead to professional entry barriers or differences in approach to a business operation. To illustrate, an IT professional may install and program a data warehouse to store information with maximum capacity in mind, whereas a professional focusing on business intelligence may emphasize strategic use of information instead.

The State of North Dakota describes business intelligence thoroughly in its 'Business Intelligence Report'. Specifically, the white paper describes business intelligence in terms of technology and infrastructure such as data mining information held within a data warehouse and using the appropriate software to perform data analytics. This helps in designing business models that have basis in logical, mathematical and qualitative assessment of business data.

Data warehousing can be thought of as a component of business intelligence that has wider scope. However, without adequate data warehousing, effective business intelligence may have little to draw valid conclusions from and therefore lead to faulty decision making. Thus, data warehousing ideally possesses qualities such as strong organization, easy access, time sensitivity and relevance. Since data warehousing takes physical space used by hardware storage, practically making use of space, and equipment to store sufficient data also involves prudent determination.

The objectives of data warehousing and business intelligence further delineate differences between the two. For example, business intelligence attempts to define, assess, observe, forecast and calculate for the benefit of a business; this is usually or ultimately financial in nature by design and function of a business. The corresponding function of data warehousing is to serve the interest of business intelligence and other business data storage needs.

Further differences between data warehousing and business intelligence include variation in software applications, employee tasks, cost and hardware needs. For example, an information technology (IT) professional familiar with magnetic, optical and solid storage devices would more likely be involved with data warehousing than an executive marketing manager seeking to make use of marketing research to implement a new product launch.

The service industry itself is differentiated in such a way as to distinguish between data warehousing and business intelligence. This is because managerial science and information technology become specialized and require specific knowledge in data warehousing and business intelligence.

Differences arising out of, and between data warehousing and business intelligence may also have the potential to lead to professional entry barriers or differences in approach to a business operation. To illustrate, an IT professional may install and program a data warehouse to store information with maximum capacity in mind, whereas a professional focusing on business intelligence may emphasize strategic use of information instead.

Sources:

1. http://bit.ly/eABq8x (North Dakota: Business Intelligence)

2. http://bit.ly/2ryqwS (Internet Journal)

3. http://bit.ly/gtLrDV (National Security Agency)

Friday, September 16, 2011

Bank Utilization of Evergreen Loans

Evergreen loans are a product issued by financial institutions such as banks to make money on interest rate spreads. If the cost of capital is lower than the revenue generated by these loans, financial instituions are more likely to issue them.

Complete article link: http://www.ehow.com/info_12063442_evergreen-loan-banking.html

Financial News 09/16/2011

• Consumer Confidence near 30 year lows per Reuters

• European balance sheet heavily weights Euro area loans

• Bank of America on 30,000 firing binge per ABC

• Trump: "Diplomats don't make good business deals" per CNBC

• Commodities prices showing lower highs per PowerShares

• European balance sheet heavily weights Euro area loans

• Bank of America on 30,000 firing binge per ABC

• Trump: "Diplomats don't make good business deals" per CNBC

• Commodities prices showing lower highs per PowerShares

Why money is an illusion

Money is a human construction, when we were a neolithic non-cultured species, money was a concept yet to be conceived. Perhaps it was a random intuition that briefly and dimly flickered in the consciousness of people more concerned about what was in front of them than what could be, for better or for worse, a 'reality'.

Image source: Anna Cervova

Illusions are thought to be deceptive, misleading or misrepresentational of reality. Money is believed to be an essential necessity, and indeed, it is in the world we have created for ourselves, but it is not per se a requirement for living which is what contributes to its illusory qualities. Rather it is an a priori deduction which is a conceptual abstraction that can be actualized through a printing press, and not a definitive empirical requirement for life.

In more concrete terms, look at the value of the dollar. It's not directly based on or 'backed' by any physical collateral such as federal real estate, presious metals etc. The dollar's value is based on perceptions of its value, belief in its worth and what it represents. Currency trader's decisions aren't always if ever based on evaluation of the dollar's actual wotrh under controlled experimental research conditions for accuracy. In other words, it's based on perceptions, beliefs, indicating financial metrics, and changes in market conditions.

It's kind of like faith! maybe that's why it says 'In God We Trust" on the back of a dollar bill.

When traditional investing strategy doesn't work

Traditional investing is good for individuals with demonstrated skill in high demand fields, and who have stable incomes with benefits protected by the Employee Retirement Income Security Act (ERISA) and insured the Pension Benefit Guaranty Corporation (PGBC). Employer retirement plans like 401(k)s, 403(b)s, 457(b)s etc. work when there's a reasonable probability of becoming vested in your career, and when the investments via those financial instruments are well guided and managed.

If you are among the 16.2 percent of Americans in the workforce as defined by the Bureau of Labor Statistics (BLS) who are either unemployed, or underemployed chances are an adjusted investing strategy is more suitable if you can find money to invest. The bottom line here is investing at all, yet alone via traditional investing strategy will be challenging. For this reason, investing isn't necessarily a realistic activity, something financial claptrap tends to avoid stating.

Instead of worrying about building a retirement fund or relying on an antiquated retirement system to solve your future financial needs, work with what you do have in the present, time. Time is arguably more valuable than money as 'time' is what is generally needed to accomplish an array of human activities. Without time money is useless but without money, time is not useless. How you use your time determines what will happen to your finances.

Thursday, September 15, 2011

Financial News 09/15/2011

Financial markets have been focused on the solvency of European financial institutions and sovereign nations within the European Economic Community. Particular attention has focused on Greece and the financial affects a formal default on its national debt would have on the Eurozone as a whole.

European officials have pushed for solutions to this problem, yet weak aspirations for further steps toward political union in the Eurozone impede the issuance of Eurobonds. These bonsds would presumably stabilise or improve the credibility, debt structure and solvency of the region.

European officials have pushed for solutions to this problem, yet weak aspirations for further steps toward political union in the Eurozone impede the issuance of Eurobonds. These bonsds would presumably stabilise or improve the credibility, debt structure and solvency of the region.

• Business Times: IMF Chief issues political and economic warnings

• U.S. Stock indexes rise for fourth day on valuations and liquidity

• Weekly jobless claims increased to 428,000 per MarketWatch

• WSJ: Central banks increase liquidity to European banks

• Labor Department:.4 percent increase in August consumer prices

Wednesday, September 14, 2011

Financial News 09/14/2011

• Moody's withdraws credit rating for Italian Province of Genoa

• Federal Reserve reports consumer credit increased 5.9% in July

• World Bank executive announces economic warning per Reuters

• Greece to remain in Eurozone per MarketWatch

• Jim Cramer "feels" better after talking to Tim Geithner via CNBC

• National Retail Federation reports 0% increase in retail sales

• Federal Reserve reports consumer credit increased 5.9% in July

• World Bank executive announces economic warning per Reuters

• Greece to remain in Eurozone per MarketWatch

• Jim Cramer "feels" better after talking to Tim Geithner via CNBC

• National Retail Federation reports 0% increase in retail sales

Monday, September 12, 2011

Financial News 09/12/2011

• Greek default probability almost imminent per Yahoo Finance

• AP reports Iran's first nuclear power plant online

• Benefits of Obama's $457 billion job plan arguable per NPR

• Bloomberg reports mulitple bank downgrades of S&P 500

• MarketWatch states Chinese July imports rose more than exports

• AP reports Iran's first nuclear power plant online

• Benefits of Obama's $457 billion job plan arguable per NPR

• Bloomberg reports mulitple bank downgrades of S&P 500

• MarketWatch states Chinese July imports rose more than exports

Saturday, September 10, 2011

Taxes and Deductions for Business Office Equipment

Depending on how long business office equipment will last and its total value, equipment tax deductions can be taken via partial or full expensing or by depreciating asset worth. Although these deductions do not typically eliminate all taxes, they can help businesses lower total taxes due.

Complete article link: http://smallbusiness.chron.com/taxes-office-equipment-22278.html

Friday, September 9, 2011

Financial News For the Business Week Ending 09/09/11

• Dollar Index reaches 3 month high

• ECB resignation highlights bond contentions per MarketWatch

• Dow Jones Industrial Average falls below 11,000

• U.S. wholesale sales flat for July per U.S. Commerce Department

• Reuters reports possible Fitch downgrade of Chinese debt

• SBT: Overpriced Indian equity and Questionable Japanese recovery

• ECB resignation highlights bond contentions per MarketWatch

• Dow Jones Industrial Average falls below 11,000

• U.S. wholesale sales flat for July per U.S. Commerce Department

• Reuters reports possible Fitch downgrade of Chinese debt

• SBT: Overpriced Indian equity and Questionable Japanese recovery

Wednesday, September 7, 2011

Financial News 09/07/2001

• WSJ reports pending Swiss central bank currency intervention

• Scotiabank Group downgrades Global GDP to 3.9 percent

• Market rally and storms push oil price to $90 per barrel

• Global inflation moderate to high throughout world per WSJ

• CNN reports $300 billion fiscal job policy is in the works

• Scotiabank Group downgrades Global GDP to 3.9 percent

• Market rally and storms push oil price to $90 per barrel

• Global inflation moderate to high throughout world per WSJ

• CNN reports $300 billion fiscal job policy is in the works

'Gangsta Insurance' and 'Wu Tang Financial'

Source: Dave Chapelle 'Wu-Tang Financial'

Source: Mad TV: 'Gangsta Insurance'

Monday, September 5, 2011

Tips for new sales people

Several techniques can be used to improve acclimation into a new sales job. Even though not all sales positions are the same, there are some largely universal sales tips and techniques that can assist many new sales positions. Below are a few tips that can develop your sales and marketing skill by helping make the most of your sales efforts.

• Learn about potential clients

Clients are number one in sales because the success of your job is heavily dependent on if they buy or not. Think of your clients first, your product or service second and your company and self third. This prioritizes your sales efforts in a way that can bring results and leverage to your bottom line objectives.

• Communicate effectively

Communication is a huge part of sales because what you say and how you conduct any sales effort determines how well your message is delivered apart from pre-designed sales information and scripts. Effective communication addresses a contact's emotions, schedule, needs, finances, interests and personality all at the same time.

• Employ sales tools

Sales literature and tools are supplements to your sales presentations, but not crutches for a lack of sales delivery expertise. Start thinking of your printed information as a tool to highlight key learning moments and points in a sales script or presentation. This will help develop and deliver a stronger product or service.

• Know your product

There's little point trying to sell something you know nothing about unless you're incredibly good at talking and connecting with people on an emotional level. Knowing your product is helpful no matter how well you communicate and helps you answer questions well demonstrating both professionalism and expertise.

• Distinguish leads quickly

Time really is money in addition to effort. By being able to identify hot and cold leads quickly will save you wasted effort and put you in control of the situation. For example, an opening question such as "Do you know how your car can make you money?" both introduces a need for more money, and identifies the willingness or interest of a lead to both answer your question and communicate.

• Follow up with leads

Potential buyers may be interested in a product or service but not so interested to follow up themselves. They may also be too busy or forget to follow up on what you have presented to them. Some leads may be entertained by your efforts and have no intention to buy so be precise and quick with your follow ups. Those that don't schedule a meeting by the second or third follow up go from warm to less warm.

• Utilize company resources

Keep in mind sales encompasses a vast amount of product and services, so each new sales job is likely to have differences related to product or service offered, lead generation procedures, sales support, payment structure and so on. Your manager and company may already have a strong sales program in place, this can be to your advantage if you are able to merge you pre-existing sales techniques into their sales program. You can also improve your sales methods by learning from more experienced sales people at your company, and by consulting additional resources such as the following.

• Learn about potential clients

Clients are number one in sales because the success of your job is heavily dependent on if they buy or not. Think of your clients first, your product or service second and your company and self third. This prioritizes your sales efforts in a way that can bring results and leverage to your bottom line objectives.

• Communicate effectively

Communication is a huge part of sales because what you say and how you conduct any sales effort determines how well your message is delivered apart from pre-designed sales information and scripts. Effective communication addresses a contact's emotions, schedule, needs, finances, interests and personality all at the same time.

• Employ sales tools

Sales literature and tools are supplements to your sales presentations, but not crutches for a lack of sales delivery expertise. Start thinking of your printed information as a tool to highlight key learning moments and points in a sales script or presentation. This will help develop and deliver a stronger product or service.

• Know your product

There's little point trying to sell something you know nothing about unless you're incredibly good at talking and connecting with people on an emotional level. Knowing your product is helpful no matter how well you communicate and helps you answer questions well demonstrating both professionalism and expertise.

• Distinguish leads quickly

Time really is money in addition to effort. By being able to identify hot and cold leads quickly will save you wasted effort and put you in control of the situation. For example, an opening question such as "Do you know how your car can make you money?" both introduces a need for more money, and identifies the willingness or interest of a lead to both answer your question and communicate.

• Follow up with leads

Potential buyers may be interested in a product or service but not so interested to follow up themselves. They may also be too busy or forget to follow up on what you have presented to them. Some leads may be entertained by your efforts and have no intention to buy so be precise and quick with your follow ups. Those that don't schedule a meeting by the second or third follow up go from warm to less warm.

• Utilize company resources

Keep in mind sales encompasses a vast amount of product and services, so each new sales job is likely to have differences related to product or service offered, lead generation procedures, sales support, payment structure and so on. Your manager and company may already have a strong sales program in place, this can be to your advantage if you are able to merge you pre-existing sales techniques into their sales program. You can also improve your sales methods by learning from more experienced sales people at your company, and by consulting additional resources such as the following.

Sources:

1. http://bit.ly/auqriV (Bureau of Labor Statistics)

2. http://bit.ly/acWGcb (Sales Tips and Techniques)

3. http://bit.ly/9wUTLk (Entrapreneur.com)

Thursday, September 1, 2011

Financial News 09/01/2011

• U.S. Government blocks AT&T acquisition of T-Mobile per WSJ

• BLS reports new jobless claims remain above 400,000

• Chinese manufacturing treading water according to Reuters

• German economy slows to .1 percent in second quarter

• Bloomberg bases commodities price drops on manufacturing data

• BLS reports new jobless claims remain above 400,000

• Chinese manufacturing treading water according to Reuters

• German economy slows to .1 percent in second quarter

• Bloomberg bases commodities price drops on manufacturing data

Subscribe to:

Comments (Atom)

:.

:.